Renters Insurance in and around Hilo

Renters of Hilo, State Farm can cover you

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- Hilo

- Keaau

- HPP

- Pahoa

- Kurtistown

- Mountain View

- Volcano

- Pepeekeo

- Paukaa

- Naalehu

- Kailua Kona

- Waikoloa

- Orchidland

- Honolulu

- Kapolei

- Makakilo

- Hawaii County

- County of Honolulu

Calling All Hilo Renters!

Trying to sift through savings options and coverage options on top of family events, keeping up with friends and your pickleball league, isn’t easy. But your belongings in your rented townhome may need the terrific coverage that State Farm provides. So when mishaps occur, your videogame systems, furnishings and sound equipment have protection.

Renters of Hilo, State Farm can cover you

Rent wisely with insurance from State Farm

Protect Your Home Sweet Rental Home

You may be wondering: Could renters insurance help you? Imagine for a minute the cost of replacing your belongings, or even just one high-cost item. With a State Farm renters policy behind you, you don't have to be afraid of thefts or accidents. But that's not all renters insurance can do for you. It extends beyond your rental space, covering personal items you've secured in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Hope Chu Hing can help you add identity theft coverage with monitoring alerts and providing support.

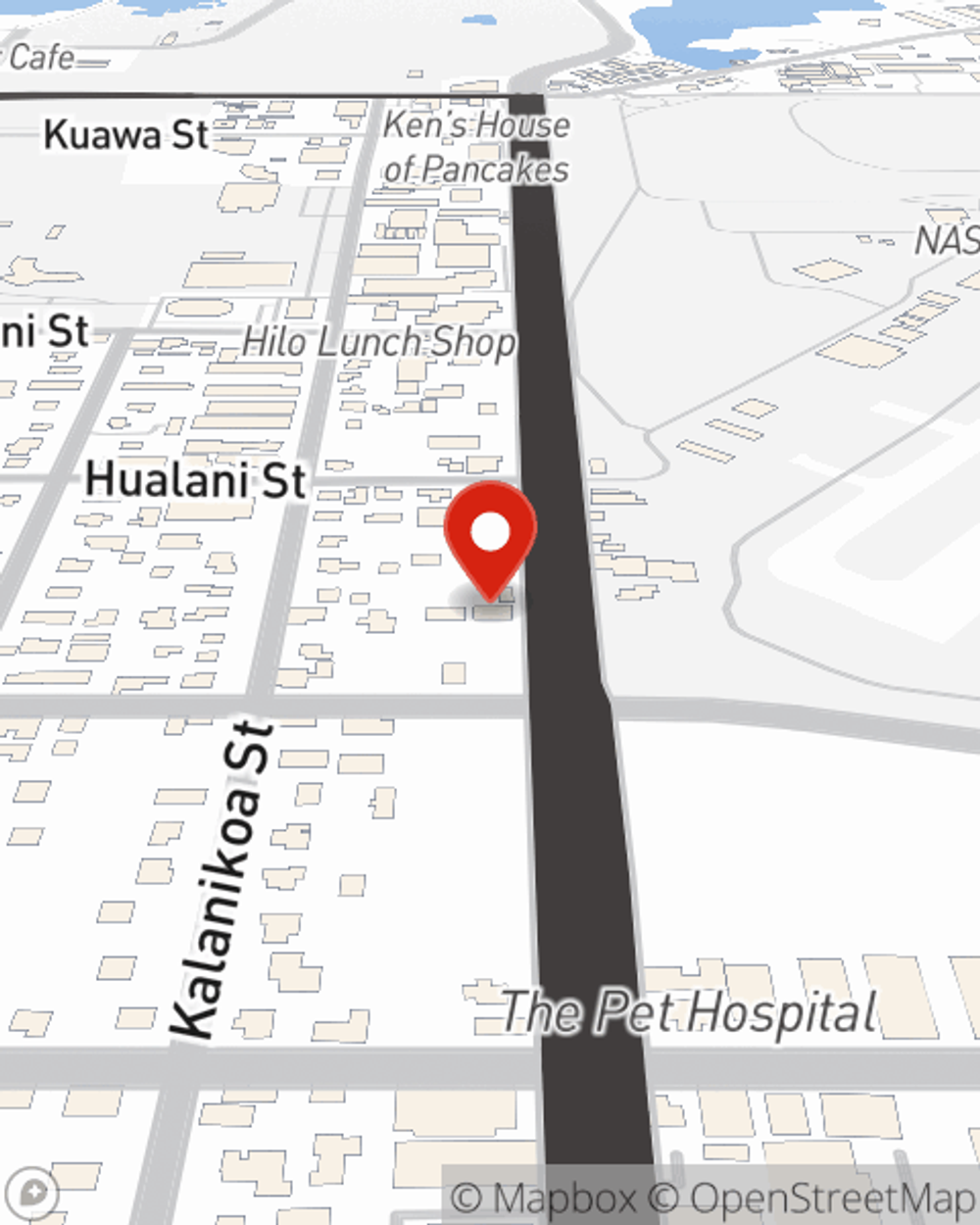

As a reliable provider of renters insurance in Hilo, HI, State Farm helps you keep your home safe. Call State Farm agent Hope Chu Hing today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call Hope at (808) 935-3157 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Hope Chu Hing

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.